Jun 10, 2024

The Story of Chinese Starlink: An overview of Guowang, G60 and more

Guowang is China's national answer to Starlink. Back in early 2015 SpaceX announced the Starlink project to provide global internet access. This is not the first of their proposals but what makes Starlink so successful is the scale of their operation and them launching their own satellites at a high rate. The Chinese have been observing these new capabilities and working on constellations on their own as the economic, strategic, and political benefits became increasingly obvious

Starlink has truly changed the space sphere as it is a crucial reason for SpaceX's extremely high cadence. It extends internet access, draws a large amount of customers across various industries, and even played a part in the Russian-Ukraine conflict.

CASC announced Hongyan in response to this. It would be a satellite constellation similar to Starlink but less capable and covering more fields of use. The project received 20 billion yuan in investment and was supposed to deploy 60 satellites by 2022 and start full-scale deployment in 2025. At the same time however CASIC (Another State-owned space conglomerate) pursued a similar project, it announced the Hongyun constellation with 156 satellites and plans to build the factories came together. At first, these plans materialized very quickly as the manufacturing sights popped up immediately and each launched concept validation satellites. In 2019 CASC expanded its plans to 864 satellites, but the aggressive timeline fell apart after this.

In 2020 China's broadband constellations then merged into one. The NDRC (National Development and Reform Commission) flagged the satellite internet project as a critical infrastructure component of the country. The NDRC is in charge of planning private and state-owned enterprises' direction in the economy. This is how China facilitates the application of their long-term plans such as their high-speed rail project, BeiDou satellite constellation, and more. The NDRC flagging this project of such great importance essentially guarantees China's commitment to challenging this domain, similar to how China has challenged the electric vehicle industry.

China then sent in two Spectrum Allocation filings for large constellations that would total up to around 12 thousand satellites. This is when the name Guowang emerged which means National Network. China initially spearheaded a super constellation and established a new company called China SATNET which would be the operator of Guowang.

Private Sector

In 2014 China started opening up their space industry to the private sector and this led to the emergence of a new era for Chinese space. Several satellite and rocket manufacturers started to come online but the private sector still had to be very much so led by national plans and SOEs. China's developmental contracts essentially guide the development of these companies and one key avenue has been the deployment of the Guowang constellation.

Although the deployment has not begun, several new rockets in China meet very specific specifications that would fit the capabilities necessary for China's internet constellation. Beijings perspective was that satellite internet would have to be wholly state-owned so it limited any private industries to ever operate a satellite internet constellation. Yet manufacturing was opened up to the private sector. This led to several state and private sectors opening up mega factories to construct the Guowang constellation.

China SATNET has much more flexibility with who it gets its manufacturing from, this opened up an emerging space industry in China. As the space sector matured more and more state restrictions subsided but state influence did not. China still wants to guide the direction of these emerging programs. We can see this with LandSpace's latest constellation announcement that has a mixture of private and state-owned backers.

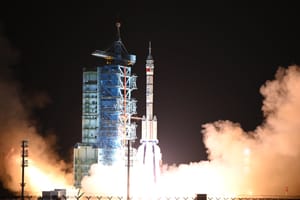

In 2022 China said it would fly its Long March 5B, which has a launch capacity of 25 tons, into LEO to launch Guowang satellites. The rocket would be used with a modified upper stage to deploy satellites for Guowang. The Long March 5B might still launch this constellation however it launches very infrequently so it would only be for test flights. To reach a significant launch cadence China is looking at multiple private reusable rockets coming online that aspire to reach double-digit reuse. China also is building a production facility in Wenchang to mass produce a modified Long March 8 that hopes to launch 50 times a year to support Guowang deployment.

Launch Plans

Some reports claim China is expected to launch the first satellites for Guowang later this year, but they currently lack the capacity to build out the entire constellation in a timely manner.

Now, China is building production and testing facilities as well as new launch pads at Wenchang spaceport on Hainan island to enable a much greater launch cadence for new rockets. The Long March 8 set a national record of 22 satellites on a single launch in February 2022 as a commercial carpooling test. But it also verified its use for launching batches of satellites. Large scale deployment will start in the coming years as the factory comes online, and several private launch companies unveil their larger rockets.

“To put it simply, we have hammered out a ‘carpooling’ solution to launch many small satellites in one successful launch mission ,” Xiao Yun, chief commander of the Long March 8 rocket program, told CCTV

A new pad at Wenchang is becoming operational this year and it too should be able to support a wide variety of commercial and state owned rockets for the deployment of Guowang.

The initial plan for the Long March 5Bis rumored to have been pushed back as it would in some ways be overkill for the initial deployment. Instead many believe that a Long March 6A launch scheduled for late this year will deploy 18 Guowang satellites to verify the technology. With several large-scale factories online after this initial test Guowang deployment can officially begin. Guowang offers a chance not only to increase China's infrastructure but also to grow its space sector providing a steady stream of launch contracts.

G60 Constellation

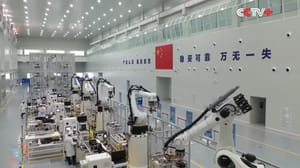

China's national plans as covered earlier have been merged into one constellation known as Guowang. However some municipalities close together in China have agreed to work together to start their own SpaceX Starlink rival known as G60. This constellation becomes even more reputable when looking at its backers, most notably Shanghai which serves as a satellite manufacturing powerhouse and a crucial part of China's space industry. It has produced its first commercial satellite on December 27th 2023, according to authorities in the city’s Songjiang district with production facilities ramping up. However G60 is behind Guowang it will emerge as well to help foster and grow China's space industry.

In the coming years launches from China will largely consist of Guowang and G60 launches. One G60 factory is expected to have a production capacity of 300 satellites per year, according to Cao Jin, general manager of Shanghai Gesi Aerospace Technology, a state-owned company established in 2022 to run the G60 Starlink factory. Under the factory’s mass production capabilities, the time required to build one satellite would be reduced from about two to three months to one and a half days, Cao added.

But the timeline is still lower than the daily production rate of six satellites by SpaceX’s Starlink. China has increased its efforts to foster the commercial satellite market that is expected to play a significant role in frontier technology amid an escalating rivalry with the United States. The 12,000-satellite G60 Starlink project, along with what is now a 13,000-satellite GuoWang national network which is currently under construction, is widely seen as China’s answer to Starlink.

China's aerospace information industry is projected to grow to 44.69 billion yuan (US$6.26 billion) by 2025, up from 29.3 billion yuan in 2021, according to an August report by China Fortune Securities. The report also noted that the aerospace information sector accounted for 73 percent of the global commercial space market, which was valued at approximately US$384 billion in 2022. This represents a clear sign of China's growing relevance in the space sector

Concluding Thoughts

With several rocket debuts, satellite manufacturing, and rocket manufacturing ramping up along with infrastructure development for various launch services. China is placing itself as a rising power once again, now eyeing the Satellite internet game to develop its own industry but also to grow itself into a modern space power. As China's industry grows and accessing space becomes easier and easier we become closer to the cosmos.